Maryland Truck Insurance

Maryland Commercial Truck Insurance

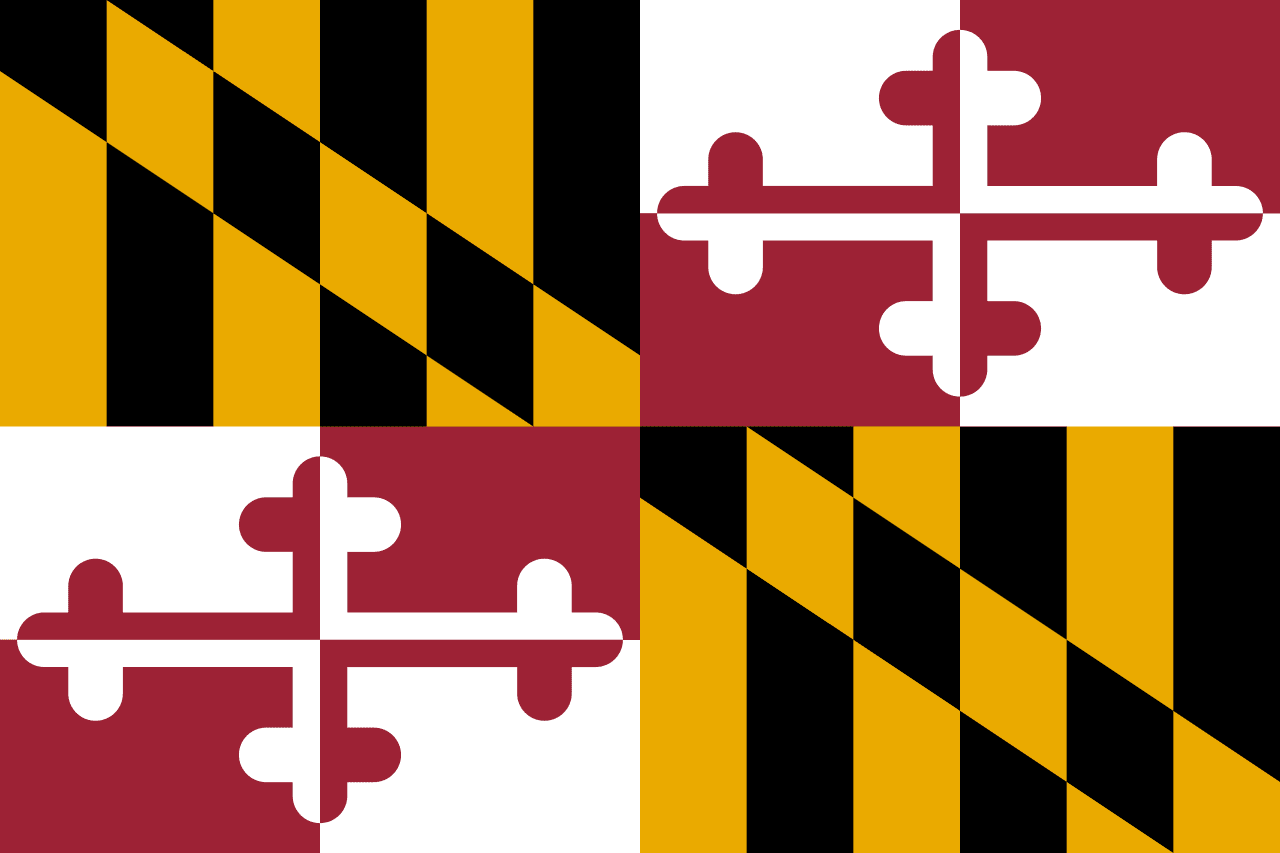

If you've ever taken a drive through Maryland, you know it isn’t just the birthplace of our national anthem, but a hub of diverse landscapes, from the sandy dunes of Ocean City to the mountainous terrains of Western Maryland. Besides crab cakes, sailboats, and Edgar Allan Poe tales, there's something else synonymous with this state: trucks! Yep, those big rigs you see cruising down I-95, hauling everything from seafood to electronics, play a crucial role in Maryland's economy. So, let’s buckle up and dive into the world of Maryland commercial truck insurance, shall we?

With Baltimore's bustling port, trucks transport a variety of commodities. Fresh seafood, farm produce, manufactured goods, you name it – the Free State's got it all! Roaming through major cities like Baltimore, Annapolis, and Frederick, and maneuvering interstates like I-70 and I-83, these vehicles are the lifeblood of Maryland's logistics.

Understanding Maryland Trucking Insurance Coverages

Auto Liability

Crucial for every trucker in Maryland. Accidents happen, even on a clear day in Silver Spring. This coverage takes care of damages caused by your truck in those unforeseen events. Carrying adequate auto liability insurance is crucial for trucking companies operating in Maryland. This coverage pays for property damage and injuries if one of your commercial trucks causes an accident. For example, if one of your drivers rear-ends a car on I-95, your liability policy will cover the other motorist's vehicle repairs, medical bills, and lost income. Without sufficient coverage, you could be sued directly and held responsible for extensive damages. It is recommended to have at least $1 million per accident, but $2 million or more is optimal for Maryland truckers given the potential for high jury verdicts. This gives you peace of mind that an unfortunate accident will not financially devastate your business.

Physical Damage

Physical damage coverage pays to repair or replace your trucks and trailers if they're damaged or stolen. For example, say you're hauling a load through Annapolis and a distracted driver sideswipes your shiny Kenworth, smashing the side panels. Or that brand new reefer trailer gets lifted from your yard overnight. With physical damage coverage, you'd get cash to fix up your rides or replace 'em if they're totaled. Without it, you're on the hook for those major repair bills and replacement costs yourself! Ouch. Experts recommend comprehensive and collision coverage with deductibles you can afford. And make sure your policy pays actual cash value or replacement cost so you get enough dough to buy another big rig. The TIS team will help you get the right physical damage policy to protect your assets and keep your business rolling.

Motor Truck Cargo

Maryland's diverse goods, be it Chesapeake Bay crabs or tech gadgets, need protection en route. This coverage ensures your cargo isn't left out in the cold. Motor truck cargo insurance is a critical coverage for trucking companies hauling goods across Maryland for clients. This policy protects in the event of loss or damage to cargo in your care, custody, or control. For example, if one of your dry vans overturns in an accident and destroys thousands of dollars’ worth of electronics inside, cargo insurance will pay to replace the damaged items. It covers accidents, theft, flooding and more. Without adequate limits, you'd have to reimburse shippers for lost or damaged freight out of your own finances. At least $100,000 in coverage is recommended but optimal limits depend on your typical load values. With the right motor truck cargo coverage, Maryland truckers can confidently haul goods knowing they are protected from loss.

Reefer Breakdown

Hauling perishable goods through the humid summers? This is a lifesaver ensuring temperature-sensitive items remain fresh. For trucking companies transporting temperature-controlled cargo in Maryland, reefer breakdown coverage is vital protection. This policy pays for loss or spoilage of perishable freight if the refrigeration unit on your trailers fails during transit. For example, if a reefer unit malfunctions due to an electrical issue and $10,000 worth of fresh seafood melts en route, reefer breakdown coverage will reimburse you for the cargo loss. It also covers repairs to the unit itself. Without this specialty insurance, you'd have to pay substantial claims out of your own pocket. This gives Maryland refrigerated haulers peace of mind that their sensitive freight is protected.

Non-Owned and Trailer Interchange

Swapping trailers in bustling Gaithersburg? You need protection for trailers that aren't originally yours. This one's got your back. For trucking companies in Maryland that utilize equipment they don't own, non-owned trailer and trailer interchange insurance is critical protection. This policy pays for damage to trailers you don’t own if they are involved in an accident while in your use. For example, if you are pulling a trailer rented through an interchange agreement and it overturns, this coverage pays for repairs, so you avoid liability. Without it, you could be held responsible for the entire value of the destroyed trailer. Non-owned trailer insurance also covers cargo losses if the equipment is hauling a load. This specialized coverage helps Maryland truckers mitigate risks when operating equipment not owned by their company.

Non-Trucking Liability

In Maryland's bustling world of commercial trucking, it's essential to understand the different types of coverage that can safeguard your business, and one of the most crucial yet often overlooked is non-trucking liability coverage. Think of this as the shield for your rig when you're off the clock. Let's say you've finished a job in Baltimore and decide to head over to Ocean City for a well-deserved break. On your way, even though you're not hauling any freight, a mishap occurs. Perhaps a tire blows out, causing minor damages to a nearby vehicle. Non-trucking liability steps in here, covering the damage costs even when you're not on a job. In essence, it's the coverage that watches over your truck during those personal detours.

Excess Liability

In the dynamic realm of commercial trucking in Maryland, there's a coverage that acts as an extra safety net, aptly named excess liability coverage. Picture this: you're hauling a precious cargo from Annapolis to Cumberland. Unfortunately, along the way, a mishap occurs, resulting in damages surpassing your primary liability limits. This is where excess liability shines. Imagine it as an extra layer of armor, ready to kick in when your primary coverage is exhausted. For instance, if your primary policy covers up to $1 million, but a claim arises costing $1.5 million due to a multi-vehicle accident on I-70, the excess liability will cover that additional $500,000. In Maryland's unpredictable terrains and busy routes, such situations, while rare, can be financially devastating. Excess liability ensures that even in worst-case scenarios, your commercial trucking operation remains shielded from crippling costs. It's like having an umbrella on a rainy day – you hope you won't need it, but you'll be glad it's there if you do.

Workers Compensation

Workers comp insurance covers your employees' medical bills and some lost wages if they get injured while working. Let's say one of your drivers slips climbing out of their rig in Jessup, breaking their leg. Or another wrenches their back unloading cargo at a warehouse. Without workers comp, you'd pay those bills yourself which gets real expensive, real fast. But with coverage, your insurer handles the medical payments and some income replacement - taking the burden off your business. In Maryland, all employers are required to carry workers comp. Make sure you have enough to properly cover your drivers and other employees - an agent can help assess your workforce risks and get you the right policy. Can't afford not to have it - your employees are your business' most valuable asset!

Occupational Accident

Owner-operators, take note! This is essential for on-the-job injuries, especially if Workers Comp isn't in your playbook. Navigating the commercial trucking landscape in Maryland requires a keen awareness of the variety of insurance options available. One such pivotal coverage is occupational accident insurance. This coverage, often shortened to 'Occ-Acc', is designed specifically for independent contractors and owner-operators who aren't covered under traditional workers' compensation policies. Let's break it down with a real-world scenario: Imagine an owner-operator named Mike, cruising through Hagerstown, encounters unexpected icy conditions and unfortunately suffers an injury during an offloading mishap. Since Mike isn't an employee, workers' compensation wouldn't apply. Enter occupational accident insurance. It would step in to cover Mike's medical expenses and even provide a disability benefit while he's recuperating. In the trucking realm, where the line between employee and contractor can sometimes blur, it's essential to have the right protection. Occupational accident insurance serves as that safeguard, ensuring that no matter your status, you're protected on Maryland's highways and byways.

General Liability

From deliveries in Rockville to pit-stops along the bay, it covers the myriad risks of your operations. Within Maryland's bustling commercial trucking sector, understanding the nuances of various insurance coverages is paramount. Among these, truckers' general liability coverage stands out as a vital safeguard. At its core, this insurance addresses liabilities that may arise outside the direct operation of your truck. Picture this: A trucker named Sarah, while taking a break at a rest stop near Salisbury, inadvertently causes damage to the rest stop's amenities. Or perhaps, during a client meeting in Baltimore, a client slips on a document Sarah left on the floor. In these situations, it's not the truck causing the liability, but actions related to the business. Truckers' general liability steps in, covering the costs of these incidents. While the road is a trucker's primary domain, interactions and activities off the road are integral to the business. Having truckers' general liability ensures that, in Maryland's ever-evolving trucking landscape, you're protected not just on the highway, but beyond it as well.

Why Should I use a Maryland Insurance Agent?

Flatbeds, tankers, dump trucks, or LTL freight haulers – if it moves on Maryland's roads, TIS can likely insure it. From poultry to tech equipment, we tailor insurance solutions to your unique needs.

Here are some types of trucking operations we can help you find insurance for in Maryland:

- Agricultural

- Auto Haulers

- Box Trucks

- Cement Mixers

- Commercial Vans

- Dry Van

- Dump Trucks

- Flatbed

- Fleets

- Garbage Trucks

- General Freight

- Hazmat

- Heavy Haul

- Hot Shots

- Intermodal

- Livestock

- Logging

- Long Haul

- LTL Trucking

- New Ventures

- Pickups

- Reefer

- Tankers

- Towing

"Alright, but why The Insurance Store?" you ask. Let's lay it out: With half a century under our belt, The Insurance Store is a seasoned player. A family-run business, we're all about personal connections and trust. Our ties to numerous top-tier insurance carriers mean we bring the best to you, without the usual runaround.

Instant Certificates of Insurance with the TIS24 App

No more sifting through stacks of paperwork. With the TIS24 app, manage certificates, ID cards, and policy documents with just a few clicks, anytime, anywhere!

Get Assistance with your Maryland Truck Permits & Filings

Drowning in red tape? We feel you. From special permits to understanding regulations, TIS Trucking Services lightens the load, guiding you through Maryland's maze of rules.

Serving Maryland and Beyond!

While Maryland holds a special place, we've got eyes on the horizon too. Looking for truck insurance in Pennsylvania, West Virginia, Virginia or Delaware? Our team has you covered!

Get a Quote for Maryland Truck Insurance

From the cobbled streets of Annapolis to the bridges of Chesapeake, if trucking is your calling in Maryland or its neighboring states, TIS is your go-to. We’re not just any insurance agency; think of us as your co-pilot, navigator, and pit crew, all rolled into one. Want to join our convoy? Give our amiable team a ring at 888-570-3130 or get a quote. Let's ensure every journey is safe, secure, and smooth. Happy trucking!

Maryland Truck Insurance Quote

Here is what Our Happy Customers have to say

Kate was so supportive as we were trying to make a decision regarding our Home Insurance. She was professional and personable. She called when she said she would and provided the best service!Joan Sanchez

Jennifer was funny polite, and quick with it! Sent customer over COI immediately, so I didn’t lose my load. Time is money!Big Wheel Logistics

Very professional. Awesome personality made me feel comfortable doing business with a company that is responsive and actually answers the phone. Thank you Jennifer!!!LaVon Eldridge